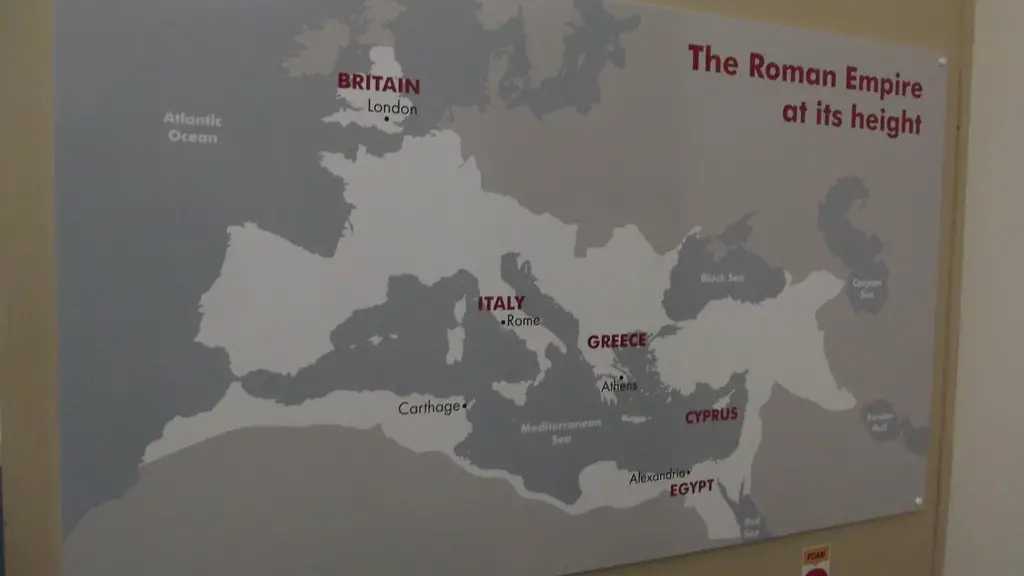

The tax system in Ancient Rome was complex, often oppressive, and certainly multifaceted. While Rome is often thought of as the most powerful empire in history, the wealth produced by this huge empire was often unequally distributed and taxed to survive. In the Republican period of Ancient Rome, taxes were derived from the provinces, provinces being regions under Rome’s rule, and were slowly imposed more heavily to the lower class and slaves in order to support the state.

Much like modern taxation, Ancient Roman taxes were paid with money. Roman coins were created in gold, silver, bronze, and copper in the Republic era. One of the most notable taxes was the Tributum, a tax on income, often derived from lands, businesses, and other holdings. This was seen as a symbol of the state’s power, especially when it came to the taxation of slaves. Furthermore, indirect taxation was imposed on various goods, services, and materials as well. Tax collection often varied by province and city, making solutions for reform difficult to implement.

One of the most interesting aspects of Ancient Roman taxation is who paid it. As the Roman Empire grew, taxes were collected from Roman citizens, wealthy individuals, and non-Roman citizens, reflecting Rome’s expanding influence and power. Additionally, the taxation of slaves was quite profitable, as slaves could not vote, often making them easier targets than the richer citizens.

Unlike modern governments, citizens in the Roman Empire did not pay taxes themselves. Wealthier citizens employed freed slaves, who were called publicans, to collect taxes on their behalf and ensure that they paid all the necessary taxes. Additionally, Roman citizens who held public offices to manage the provinces paid taxes on the income they earned.

Despite the complexity of the Roman tax system, there were some benefits to citizens. Generally, the wealthier citizens were expected to pay higher taxes than the lower classes. This could be seen as a form of wealth redistribution, as the funds collected through taxes were used to fund public works projects, like roads and bridges, as well as provide aid to lower classes.

Tax evasion was also a problem in Ancient Rome, and those who were caught evading taxes were subject to harsh punishments. Apart from monetary fines, those found guilty of evading taxes were often subject to public humiliation. This could include the humiliation of being paraded through the streets or even having their names posted in public places.

Taxation in the Roman Republic

In the Roman Republic, taxation was mainly used to support the Roman state, such as paying for wars, public festivals and other events, as well as general public works projects. The citizens of Rome paid a wide variety of taxes which were then used to pay for the state’s military, infrastructure, education, religion, and other aspects of life in the city.

In the Republic era, citizens paid different types of taxes such as the tributum soli, a tax on land and other agricultural income, and the censoratus, a tax on commerce, industry and traditions. In addition, the state also imposed indirect taxes such as customs duties, port fees, and taxes on entertainments.

Since Rome was a republic, the citizens had some control over how much they paid in taxes. Taxpayers with higher incomes were expected to pay a larger share of their income, while landowners and agricultural producers paid comparatively lower taxes.

However, since there was no established tax code, those with higher incomes could often find ways to evade paying their share of taxes. The state also imposed several fines, sometimes exorbitant ones, on those who were found guilty of evading taxes.

Taxation in the Roman Empire

As Rome transitioned from a republic to an empire, the wealth created by the state was unequally distributed, much like taxation. Roman citizens who could not pay their taxes risked being deported, enslaved, or punished, so taxes were no longer seen as an obligation to the state, but rather as a way to survive.

Under the Roman Empire, the tributum and other taxes were still collected from citizens. However, the wealthy now paid a larger share than before. Furthermore, taxes were no longer paid in coins, but in other forms, such as wheat or olive oil, or in services, such as providing soldiers for the state’s military campaigns.

Additionally, the Roman state imposed various indirect taxes such as the aurum coronarium, an annual tax on the citizens of Rome who were too wealthy to pay the tributum, and the vectigal, a tax imposed on goods entering Rome’s provinces. Furthermore, taxes were also collected from foreign citizens, sometimes in gold or silver, as a way of encouraging them to submit to Roman rule.

Even after the fall of the Roman Empire, the legacy of taxation in Ancient Rome lives on. The various types of taxes, ranging from direct and indirect taxes, to taxes on income and wealth, continue to reflect modern-day taxation. While taxation in Ancient Rome was often seen as oppressive and unfair, it was a necessary evil for the state to function and provided benefits, such as public works projects, to the citizens.

Tax Reform in Ancient Rome

In Ancient Rome, attempts to reform the tax system were unsuccessful due to the lack of an organized state. Tax reform was often implemented by provinces and townships, who received taxes from each city. However, these reforms were often met with opposition from citizens and from the wealthy classes who did not want to pay more taxes.

Rome’s first official tax law, the Edict of Clodius, was passed in 52 BCE. While this edict set out fair tax rates and regulations, it was largely ignored by citizens who found ways to evade taxes. While the state cracked down on tax evasion with various punishments, attempts to enforce the law were largely unsuccessful.

There were also attempts to reduce taxes by the Roman Senate and ruling classes. Cato the Elder proposed a law to reduce the amount of taxes paid by Roman citizens. One of the more successful attempts at tax reform was the Lex Aelia Fufia in 130 BCE, which limited exemptions from taxes and set out terms for tax collection. While it ultimately failed to completely reform the tax system, this law was still an important step towards making taxation more fair for all.

Measuring the Impact of Taxation in Ancient Rome

The impact of taxation in Ancient Rome is hard to evaluate, as taxation was a necessary but often oppressive burden on citizens. However, it can be said that the taxes imposed by the state helped to fund the expansion and maintenance of the Roman Empire, and it was arguably the most important source of income for the state.

Despite its oppressive nature, taxation in Ancient Rome was also a source of benefit to citizens. Taxes paid by wealthier citizens were a form of wealth redistribution, and the funds collected by the state went towards public works projects and aiding the lower classes. Additionally, these taxes helped to fund the military and ensure law and order in the empire.

The taxation system in Ancient Rome was thus a double-edged sword. It was oppressive, but it was also necessary for the state to function and it provided some benefits to the citizens. It is thus a testament to the complexity of Ancient Rome’s tax system, as well as its lasting legacy in modern taxation.

Tax Collectors in Ancient Rome

The job of a tax collector, or publican, was a crucial part of the Ancient Roman tax system. These publicans were often hired by wealthier citizens and were responsible for collecting taxes on their behalf, which ensured that the citizen paid their fair share.

Tax collectors in Ancient Rome were often highly educated individuals and were seen as important members of society. Since they were charged with the task of collecting taxes, they were both feared and respected. They were also seen as symbols of the state’s power, and they were often employed as envoys to other provinces to collect taxes and negotiate treaties.

While there were some benefits to being a publican, such as gaining status and wealth, there were also drawbacks. Publicans were often viewed with suspicion and distrust, and evading taxes was seen as a sign of a lack of loyalty to the state. Publicans were also subjected to harsh punishments if they were found guilty of bribery or other illegal activities.

The Morality of Taxation in Ancient Rome

The morality of taxation in Ancient Rome is a matter of debate. While taxation was a necessary part of the Roman state, it was also seen as oppressive by citizens and could often lead to hardship. This was especially true of the lower classes, who were often the targets of higher taxes, and of slaves, who were often unable to escape the burden of taxation.

The morality of taxation in Ancient Rome was also questioned by philosophers and writers. Many argued that taxation was an unjust burden on the citizens and that the state should work to alleviate the burden of taxation for everyone. Others, however, argued that taxation was an important way for the state to raise funds and maintain order.

At the end of the day, the morality of taxation in Ancient Rome is complicated. The details of the Ancient Roman tax system are still debated today, but one thing is clear; taxation was a necessary part of the Roman state and it provided benefits as well as drawbacks for citizens.

Conclusion

Taxation in Ancient Rome was a complex and multifaceted system that had a lasting impact on modern-day taxation. It was often oppressive, but it was also necessary for the state to function and it provided some benefits to citizens, such as public works projects and the funding of the Roman military. Tax evasion was also a problem in Ancient Rome, and those found guilty were subject to harsh punishments. Despite its drawbacks, taxation in Ancient Rome was an important part of the Roman state, and its legacy can still be seen today.