The Roman Republic was founded in 509 BC, and for most of its history, the Roman government was a republic governed by elected officials. The Roman tax system was implemented to fund the government and its military. Roman citizens paid their taxes with money, and the government collected taxes in the form of gold, silver, and copper coins. Non-citizens paid their taxes with goods and services.

Coins

How did Romans pay their taxes?

The Roman State reassigned the power to collect taxes to private individuals or organizations. These private groups paid the taxes for the area, and they used the products and money that could be garnered from the area to cover the outlay. This system was used in order to increase the efficiency of tax collection and to reduce the burden on the state.

The Roman Empire used a variety of different currencies during its time, including gold, silver, bronze, orichalcum, and copper. The composition of these coins changed over time, as did their denominations. This resulted in a complex and ever-changing currency system that was used throughout the Empire.

How did people pay taxes in ancient times

In ancient times, households had to pay taxes in kind, and they paid different taxes throughout the year. Poll taxes required each man to deliver a cow or sheep to the authorities. Merchants transporting goods from one region to another were subject to tolls, duty fees, and other taxes.

It is unfair to compliant taxpayers in Rhodiapolis that they have to pay more in taxes because a large number of people do not pay taxes. The taxation rate should be increased for those who don’t pay taxes, so that the burden is not placed on those who do.

What were Roman tax collectors called?

A publican was an ancient Roman contractor who was responsible for maintaining public buildings, supplying armies, or collecting taxes. Publicans were often responsible for taxes that were unpredictable, such as tithes and customs.

The ancient Romans had a unique way of storing their wealth. Typically, their money was stored in multiple temples. This practice was designed to protect their wealth in case an individual temple was destroyed or attacked in some way. Another banking group in ancient Rome were the trapezites.

Did Romans use salt as currency?

Soldiers in the Roman army were sometimes paid with salt instead of money because salt was so valuable. Their monthly allowance was called “salarium” (“sal” being the Latin word for salt).

taxes are important because they help fund programs that protect vulnerable citizens, provide public education, and finance the military. Low-income taxpayers disproportionately benefit from these programs, making taxes an important tool for addressing inequality.

What did Romans use before coins

The aes signatum was replaced by the denarius in 211 BC. The denarius, a small silver coin, became the main coin of the Roman Republic and continued to be used as a unit of measurement throughout the Roman Empire. The silver content of the denarius began to be debased during the reign of Augustus, and Nero continued the debasement, reducing the silver content by a further 50%.

The tributum was the most prominent tax in ancient Rome and it was a tax on material wealth. Citizens of Rome were not required to pay this tax, aside from times of financial need, while all non-citizens living in the Roman territory were required to pay tributum on all their property.

What did Egyptians used to pay taxes?

The Pharaohs of Ancient Egypt did not have coined money, so their taxes were levied on harvests and property. Taxes were payable at least once a year, with payment made in the form of labor or grain. Grain was stored by the Pharaoh in large warehouses, and used to pay for labor and other services.

There was no currency in ancient Egypt, so taxes were collected in the form of goods produced by the people. This was probably done because it was easier to transport and store goods than it was to transport and store currency. The government would then use these goods to fund public projects, pay for military campaigns, etc.

Did Rome fall because of taxes

The fall of the Roman Empire is attributed to many things, one of which has a contemporary ring to it: The Roman Empire deteriorated due to oppressive taxation. Though perhaps not the core issue, the greatest burden to the average citizen could easily have been the extreme tax burden.

The tax was initially imposed by Roman emperor Vespasian as one of the measures against Jews as a result of the First Roman-Jewish War, or first Jewish revolt of AD 66–73. The tax was imposed on all Jews throughout the empire, not just on those who took part in the revolt against Rome.

Was there taxes in Jesus time?

The use of Syrian, Roman, and Jewish coins during the time of Christ highlights the immense tax burden that was placed on the people of that time. The Roman Government imposed heavy taxes on its subjects, and the people of Israel also had to pay a tax to the temple. Publicans, or tax collectors, were known for their corruption, and this placed a great financial strain on the people.

The common treasury was used to finance the operations of the state, including the military. The sacred treasury was used to finance the upkeep of the temples and other religious institutions.

Conclusion

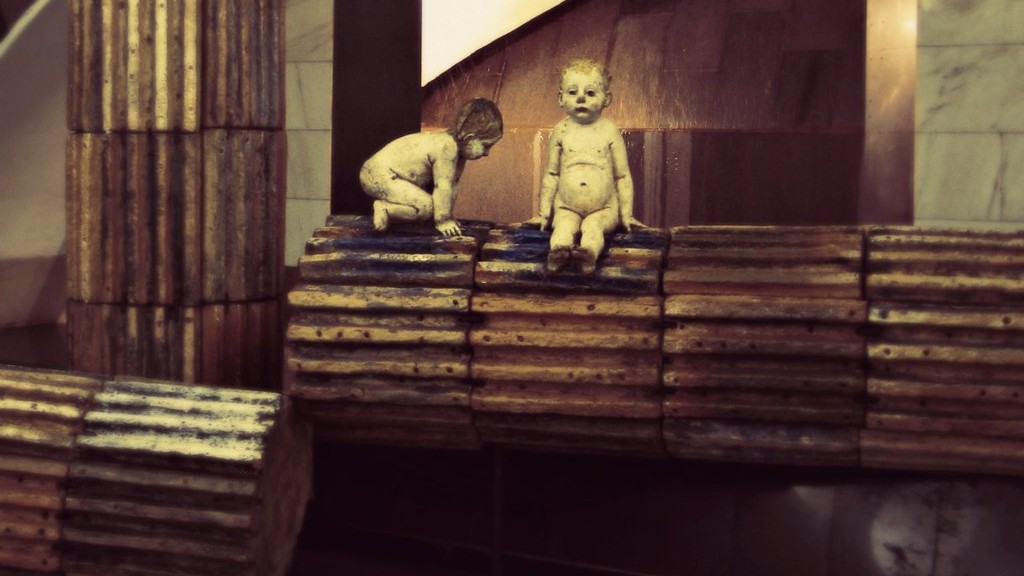

Ancient Romans paid their taxes with coins. The coins were made of bronze and copper and bore the image of the emperor.

The ancient Romans paid their taxes with gold, silver, and bronze coins. They also used these metals to make jewelry, statues, and other art.